Personal Contract Hire (PCH) Car finance

How does PCH work?

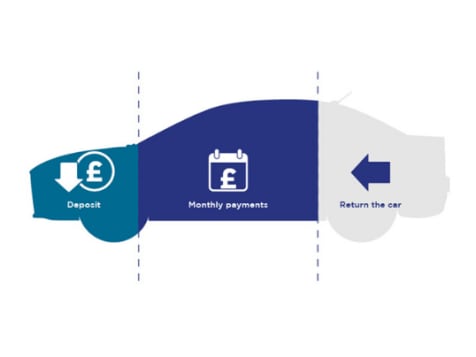

If you never want to own the car, and you know this from the beginning, then you might want to consider personal contract hire instead of the other finance options such as PCP . If you’re not planning to buy the car at the end of a PCP, then PCH could turn out to be the cheaper option for you.

Latest Offers

Same as with the PCP, you are going to have to pass some sort of credit check. It’s likely that you’ll be asked to pay a few months of the lease upfront, and this is usually around three – six months. You’ve got to know what you’re agreeing to and be confident that you’re going to be able to make the repayments for the entire length of the contract.

Once you have the car, you can use it as long as you are sticking to your agreed mileage. If you do happen to go over this, then you will be charged for as much as you go over. However, costs such as car tax are included, so you’re only going to have to pay for the fuel, maintenance and insurance. Your contract should allow for general wear and tear, but anything beyond this could mean that you face extra charges. To avoid this, just keep it in good condition then, at the end of the agreement, you return the car. It really is as simple as that.

Why Choose Swansway Motor Group Contract Hire.

Wide Range of Vehicles to Choose From

From sleek saloons to powerful off-road vehicles. With a huge range of makes and models, you’re sure to find a vehicle that’s a great fit for your business needs and your brand image.

Outstanding Customer Service

We promise to be honest and caring in our approach, helping you to make informed choices on behalf of your company without trying to bamboozle you with technical jargon.

Fixed Monthly Fees

Enjoy peace of mind with fixed monthly payments set by you, so you can plan accurate cash flow projections without needing to worry about unpredictable costs.

Maintenance and Servicing

With our optional maintenance and servicing plans you can let Swansway take care of everything, so you and your employees can simply enjoy your brand-new vehicles.

A big advantage of this type of car finance is that if you are someone who doesn’t want to commit to a car, then this is perfect for you. You only have it for the duration of the contract, and then you give it back and move on. But, this can also be a disadvantage if you grow to like the car over the period, because there is no purchase option.

So, now you have all the information about each type of car financing, including how it works as well as some of the advantages and disadvantages, you can start to work out which financing option is going to be the best for you. You can consult a professional if you feel like you need more advice after reading this explanation. Make sure that you check all the information that the lender gives you to ensure it matches up with what you know before you agree to anything.