For many, the process of applying for car finance might seem straightforward. You submit your application, and as long as you have a steady income, your chances of approval should be reasonable, right? Not exactly. Unfortunately, there are various reasons why your car finance application might be declined, leaving you without that beloved new set of wheels. This blog post dives deep into the potential obstacles that could lead to a denied car finance application.

The Importance of Car Finance Approval

Understanding the importance of a car finance application is the first step toward a smoother and more successful application process. Unlike some other forms of credit, such as a credit card, a car finance refusal can jeopardize your immediate needs for reliable transportation. Each refusal can also leave a mark on your credit report, potentially worsening your credit score and making future applications—even for non-car loans—more difficult. Here are the main reasons why you car finance application could be refused.

Your Credit Score

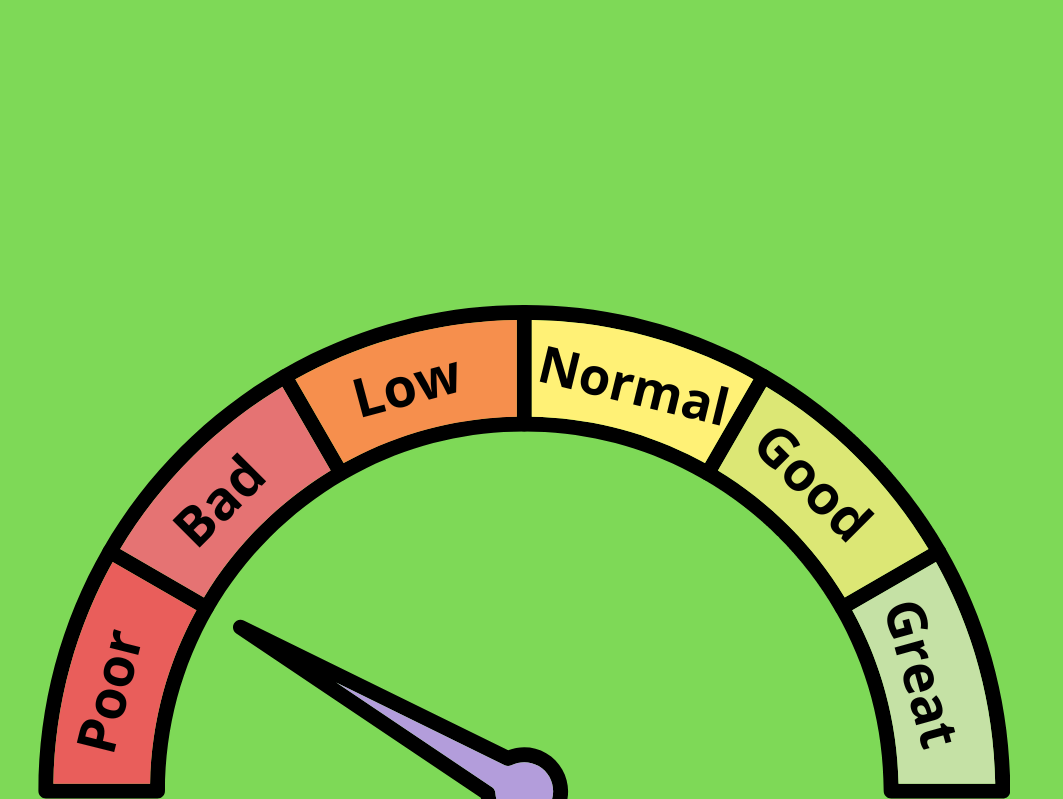

One of the most influential factors in car finance approval or refusal is your credit score. Lenders use credit scores as a signal of your financial health and your likelihood to repay the loan. Consistently late payments, defaults, or even bankruptcy can significantly impair your score, reducing the chance of car finance approval.

Credit scores are a reflection of your past financial behavior. For car finance lenders, a poor credit history is worrying, as it indicates a higher risk of late payments or defaults on the new loan. Understanding your credit score and taking measures to improve it before applying for car finance is essential. Online tools can provide insights into your current creditworthiness and areas for improvement.

Inadequate Affordability

Lenders assess your affordability for car finance by comparing your income and existing financial commitments to the size of the loan. Even with a solid credit score, your application could be refused if the lender determines that the monthly payments would stretch your budget too far.

Before applying for car finance, review your monthly income and outgoing expenses to determine how much you can afford to spend on a car loan. Consider all your living costs, existing debts, and allow for emergency savings. The general rule of thumb is that your monthly car payment should not exceed 15-20% of your monthly take-home pay.

Income and Employment

Your income and employment status further illustrate to lenders your capacity to meet loan repayments. Continuity and consistency in both areas are vital to having an application approved.

Lenders will favour applicants with stable, regular income. For those who are self-employed or with variable income, proving a consistent earnings history could make all the difference. Making a larger down payment to reduce the loan amount can also offset some of the risk due to irregular income.

Your employment history, especially if you've changed jobs frequently or have extended gaps in employment, can be a red flag for lenders. It signals instability and can cast doubt on your future ability to repay the loan. Stability in employment, where you have been with your current employer for a number of years, can mitigate this concern for lenders.

Age Restrictions

Age is another factor that can lead to a refusal of car finance. Many lenders have age restrictions, typically at the younger and older ends of the spectrum, to mitigate the risk of lending to those who may have less ability to repay or expect to be in employment for a shorter time due to retirement, for example.

If you’re a young applicant, consider obtaining a loan co-signer with a good credit history or saving for a larger deposit to enhance your application. For older borrowers, providing evidence of a healthy retirement fund or opting for a shorter loan term can ease some of the age-related concerns for lenders.

Application Errors

Sometimes, applications are refused because of errors made during filling. Common mistakes include incorrect personal information, misleading financial details, or failing to disclose outstanding debts or existing finance agreements, which may lead the lender to believe you misrepresented your application.

Deliberate misrepresentation of your financial status in a car finance application can result in immediate decline and potentially legal repercussions. Always double-check your application for accuracy before submission.

Understanding and Overcoming Refusals

Car finance rejections can be a tough pill to swallow, but understanding why they happen is the first step to preventing future disappointments. By focusing on improving your credit score, assessing and managing your affordability, and ensuring your income and employment backgrounds are as favourable as possible, you can significantly increase your chances of securing car finance. Remember, transparency and accuracy in your application are crucial. Take these tips on board, and your next car finance application could very well be the "yes" you've been waiting for.